Moving?

-

72Hardtop

- Old School!

- Location: Seattle, WA./HB. Ca./Shizuoka, Japan

- Status: Offline

Moving?

http://www.bloomberg.com/news/articles/ ... itizenship

More Americans living outside the U.S. gave up their citizenship in the first quarter of 2015 than ever before, according to data released Thursday by the IRS.

The 1,335 expatriations topped the previous record by 18 percent, according to data compiled by Bloomberg. Those Americans are driven to turn in their passports in part because of laws that have expanded bank reporting and tax compliance requirements for expatriates.

The increase in early 2015 follows an annual record in 2014, when 3,415 Americans gave up their citizenship.

An estimated 6 million U.S. citizens are living abroad, and the U.S. is the only country within the Organization for Economic Cooperation and Development that taxes citizens wherever they reside.

In many cases, those choosing to give up their citizenship have limited connections to the U.S. and have lived outside of the country for most of their lives. Anyone born in the U.S. automatically receives citizenship, and people born abroad to U.S. parents are typically citizens as well.

For some the decision is easy, because they perceive little benefit from holding U.S. citizenship. For others, the choice is more complicated.

‘Highly Distressing’

“The cost of compliance with the complex tax treatment of non-resident U.S. citizens and the potential penalties I face for incorrect filings and for holding non-U.S. securities forces me to consider whether it would be more advantageous to give up my U.S. citizenship,” Stephanos Orestis, a U.S. citizen living in Oslo, wrote in a March 23 letter to the Senate Finance Committee. “The thought of doing so is highly distressing for me since I am a born and bred American with a love for my country.”

London Mayor Boris Johnson, who had a tax dispute with the IRS, said earlier this year that he would give up the U.S. citizenship he received because he was born in New York. His name isn’t on the IRS list. Eduardo Saverin, a Brazilian-born co-founder of Facebook Inc., gave up his U.S. citizenship in 2012.

U.S. citizens who live abroad can exclude as much as $100,800 in earned income and in many cases can receive tax credits for payments to foreign governments.

Tax Cheats

The U.S. has increased efforts to catch tax cheats after the Swiss bank UBS AG paid a $780 million penalty in 2009 and handed over data on about 4,700 accounts. That has led some banks to forgo doing business with people who have ties to the U.S.

One of the primary U.S. moves took effect last year as asset-disclosure rules under the Foreign Account Tax Compliance Act kicked in. The measure, known as Fatca, requires U.S. financial institutions to impose a 30 percent withholding tax on payments made to foreign banks that don’t agree to identify and provide information on U.S. account holders.

It allows the U.S. to scoop up data from more than 77,000 institutions and 80 governments about its citizens’ overseas financial activities.

The new laws, combined with past rules, can make tax filing difficult for U.S. citizens living overseas who are trying to start businesses or set up trusts, said Andrew Mitchel. He’s an international tax lawyer in Centerbrook, Connecticut, who has been tracking expatriations.

“These are complicated rules, and these are laypeople who don’t really understand the rules,” he said. “It can be tens of thousands of dollars to file tax returns.”

In establishing the 2010 law, Congress and President Barack Obama in effect threatened to cut off banks and other companies from easy access to the U.S. market if they didn’t pass along such information. It was projected to generate $8.7 billion over 10 years, according to the congressional Joint Committee on Taxation.

More Americans living outside the U.S. gave up their citizenship in the first quarter of 2015 than ever before, according to data released Thursday by the IRS.

The 1,335 expatriations topped the previous record by 18 percent, according to data compiled by Bloomberg. Those Americans are driven to turn in their passports in part because of laws that have expanded bank reporting and tax compliance requirements for expatriates.

The increase in early 2015 follows an annual record in 2014, when 3,415 Americans gave up their citizenship.

An estimated 6 million U.S. citizens are living abroad, and the U.S. is the only country within the Organization for Economic Cooperation and Development that taxes citizens wherever they reside.

In many cases, those choosing to give up their citizenship have limited connections to the U.S. and have lived outside of the country for most of their lives. Anyone born in the U.S. automatically receives citizenship, and people born abroad to U.S. parents are typically citizens as well.

For some the decision is easy, because they perceive little benefit from holding U.S. citizenship. For others, the choice is more complicated.

‘Highly Distressing’

“The cost of compliance with the complex tax treatment of non-resident U.S. citizens and the potential penalties I face for incorrect filings and for holding non-U.S. securities forces me to consider whether it would be more advantageous to give up my U.S. citizenship,” Stephanos Orestis, a U.S. citizen living in Oslo, wrote in a March 23 letter to the Senate Finance Committee. “The thought of doing so is highly distressing for me since I am a born and bred American with a love for my country.”

London Mayor Boris Johnson, who had a tax dispute with the IRS, said earlier this year that he would give up the U.S. citizenship he received because he was born in New York. His name isn’t on the IRS list. Eduardo Saverin, a Brazilian-born co-founder of Facebook Inc., gave up his U.S. citizenship in 2012.

U.S. citizens who live abroad can exclude as much as $100,800 in earned income and in many cases can receive tax credits for payments to foreign governments.

Tax Cheats

The U.S. has increased efforts to catch tax cheats after the Swiss bank UBS AG paid a $780 million penalty in 2009 and handed over data on about 4,700 accounts. That has led some banks to forgo doing business with people who have ties to the U.S.

One of the primary U.S. moves took effect last year as asset-disclosure rules under the Foreign Account Tax Compliance Act kicked in. The measure, known as Fatca, requires U.S. financial institutions to impose a 30 percent withholding tax on payments made to foreign banks that don’t agree to identify and provide information on U.S. account holders.

It allows the U.S. to scoop up data from more than 77,000 institutions and 80 governments about its citizens’ overseas financial activities.

The new laws, combined with past rules, can make tax filing difficult for U.S. citizens living overseas who are trying to start businesses or set up trusts, said Andrew Mitchel. He’s an international tax lawyer in Centerbrook, Connecticut, who has been tracking expatriations.

“These are complicated rules, and these are laypeople who don’t really understand the rules,” he said. “It can be tens of thousands of dollars to file tax returns.”

In establishing the 2010 law, Congress and President Barack Obama in effect threatened to cut off banks and other companies from easy access to the U.S. market if they didn’t pass along such information. It was projected to generate $8.7 billion over 10 years, according to the congressional Joint Committee on Taxation.

1972 Westy tintop

2056cc T-4 - 7.8:1 CR

Weber 40mm Duals - 47.5idles, 125mains, F11 tubes, 190 Air corr., 28mm Vents

96mm AA Biral P/C's w/Hastings rings

42x36mm Heads (AMC- Headflow Masters) w/Porsche swivel adjusters

71mm Stroke

Web Cam 73 w/matched Web lifters

S&S 4-1 exhaust w/Walker 17862 quiet-pack

Pertronix SVDA w/Pertronix module & Flamethrower 40K coil (7* initial 28* total @3200+)

NGK BP6ET plugs

002 3 rib trans

Hankook 185R14's

2056cc T-4 - 7.8:1 CR

Weber 40mm Duals - 47.5idles, 125mains, F11 tubes, 190 Air corr., 28mm Vents

96mm AA Biral P/C's w/Hastings rings

42x36mm Heads (AMC- Headflow Masters) w/Porsche swivel adjusters

71mm Stroke

Web Cam 73 w/matched Web lifters

S&S 4-1 exhaust w/Walker 17862 quiet-pack

Pertronix SVDA w/Pertronix module & Flamethrower 40K coil (7* initial 28* total @3200+)

NGK BP6ET plugs

002 3 rib trans

Hankook 185R14's

- Amskeptic

- IAC "Help Desk"

- Status: Offline

Re: Moving?

Horsepucky, Andrew, horsepucky. If you are charging "tens of thousands of dollars" to file returns, you are clearly on the take.72Hardtop wrote: Andrew Mitchel an international tax lawyer in Centerbrook, Connecticut,

“These are complicated rules, and these are laypeople who don’t really understand the rules,” he said. “It can be tens of thousands of dollars to file tax returns.”

Colin

BobD - 78 Bus . . . 112,730 miles

Chloe - 70 bus . . . 217,593 miles

Naranja - 77 Westy . . . 142,970 miles

Pluck - 1973 Squareback . . . . . . 55,600 miles

Alexus - 91 Lexus LS400 . . . 96,675 miles

Chloe - 70 bus . . . 217,593 miles

Naranja - 77 Westy . . . 142,970 miles

Pluck - 1973 Squareback . . . . . . 55,600 miles

Alexus - 91 Lexus LS400 . . . 96,675 miles

-

72Hardtop

- Old School!

- Location: Seattle, WA./HB. Ca./Shizuoka, Japan

- Status: Offline

Re: Moving?

They are likely being charged that due to the amount of their return...a percentage. For a Millionaire or Billionaire...a drop in the bucket or pocket change.Amskeptic wrote:Horsepucky, Andrew, horsepucky. If you are charging "tens of thousands of dollars" to file returns, you are clearly on the take.72Hardtop wrote: Andrew Mitchel an international tax lawyer in Centerbrook, Connecticut,

“These are complicated rules, and these are laypeople who don’t really understand the rules,” he said. “It can be tens of thousands of dollars to file tax returns.”

Colin

1972 Westy tintop

2056cc T-4 - 7.8:1 CR

Weber 40mm Duals - 47.5idles, 125mains, F11 tubes, 190 Air corr., 28mm Vents

96mm AA Biral P/C's w/Hastings rings

42x36mm Heads (AMC- Headflow Masters) w/Porsche swivel adjusters

71mm Stroke

Web Cam 73 w/matched Web lifters

S&S 4-1 exhaust w/Walker 17862 quiet-pack

Pertronix SVDA w/Pertronix module & Flamethrower 40K coil (7* initial 28* total @3200+)

NGK BP6ET plugs

002 3 rib trans

Hankook 185R14's

2056cc T-4 - 7.8:1 CR

Weber 40mm Duals - 47.5idles, 125mains, F11 tubes, 190 Air corr., 28mm Vents

96mm AA Biral P/C's w/Hastings rings

42x36mm Heads (AMC- Headflow Masters) w/Porsche swivel adjusters

71mm Stroke

Web Cam 73 w/matched Web lifters

S&S 4-1 exhaust w/Walker 17862 quiet-pack

Pertronix SVDA w/Pertronix module & Flamethrower 40K coil (7* initial 28* total @3200+)

NGK BP6ET plugs

002 3 rib trans

Hankook 185R14's

- Bleyseng

- IAC Addict!

- Location: Seattle again

- Contact:

- Status: Offline

Re: Moving?

"It was projected to generate $8.7 billion over 10 years, according to the congressional Joint Committee on Taxation."

Yep, maybe this will help to catch the tax dodgers living outside the US. When I lived in Suriname I filed taxes in both countries, big deal.

Yep, maybe this will help to catch the tax dodgers living outside the US. When I lived in Suriname I filed taxes in both countries, big deal.

Geoff

77 Sage Green Westy- CS 2.0L-160,000 miles

70 Ghia vert, black, stock 1600SP,- 139,000 miles,

76 914 2.1L-Nepal Orange- 160,000+ miles

http://bleysengaway.blogspot.com/

77 Sage Green Westy- CS 2.0L-160,000 miles

70 Ghia vert, black, stock 1600SP,- 139,000 miles,

76 914 2.1L-Nepal Orange- 160,000+ miles

http://bleysengaway.blogspot.com/

- yondermtn

- Old School!

- Location: IL

- Status: Offline

Re: Moving?

72Hardtop wrote: They are likely being charged that due to the amount of their return...a percentage. For a Millionaire or Billionaire...a drop in the bucket or pocket change.

CPAs and tax attorneys aren't allowed to prepare returns based on contingent fees.

The laws are very confusing and it is difficult to find professionals qualified to interpret them. I don't have much experience with US citizens living abroad, but I do have experience with US citizens who have foreign accounts. I'd advise against any foreign accounts unless absolutely necessary. The reporting requirements and the changing laws aren't worth the hassle or expense.

1977 Westy 2.0FI

1990 Vanagon MV 2.1 Auto

1990 Vanagon MV 2.1 Auto

- hippiewannabe

- Old School!

- Status: Offline

Re: Moving?

Classic case of static analysis. In the real world, people and the economy are dynamic. When you go after a higher percentage of people's income, they don't just stand there and take it; the income, or in this case the citizenship, moves. This is why tax revenue increased when Reagan cut marginal rates; less game playing to hide the income, and more honest investment and reported wages exposed to a fair rate.Bleyseng wrote:"It was projected to generate $8.7 billion over 10 years, according to the congressional Joint Committee on Taxation."

Yep, maybe this will help to catch the tax dodgers living outside the US. When I lived in Suriname I filed taxes in both countries, big deal.

Truth is like poetry.

And most people fucking hate poetry.

And most people fucking hate poetry.

- Bleyseng

- IAC Addict!

- Location: Seattle again

- Contact:

- Status: Offline

Re: Moving?

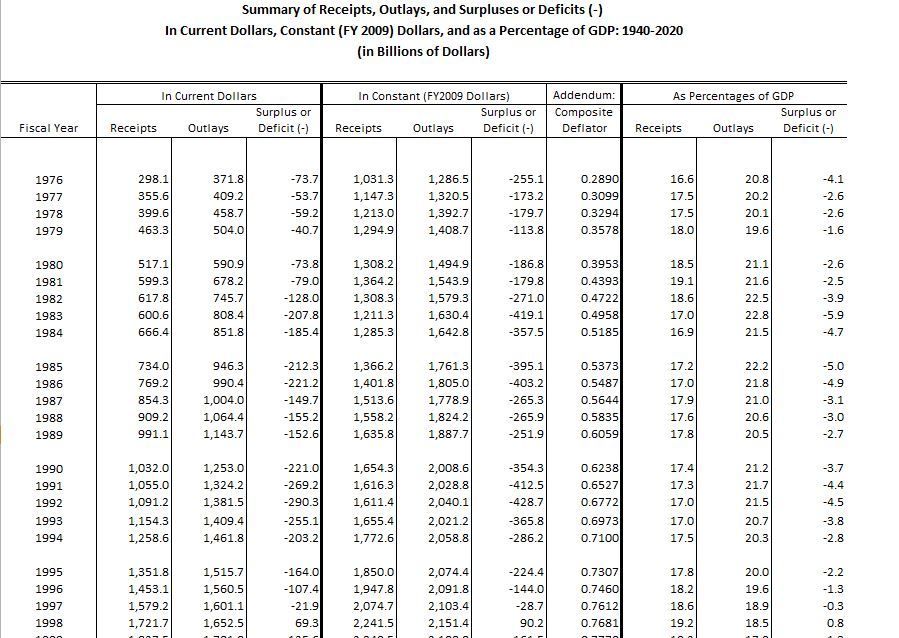

Huh? Then why did he run such huge deficits. I thought it was just like GW Bush that they cut the taxes and spent more expecting the economy to boom but it didn't happen. (Trickle Down Economics) Same BS the GOP is mouthing now.hippiewannabe wrote:Classic case of static analysis. In the real world, people and the economy are dynamic. When you go after a higher percentage of people's income, they don't just stand there and take it; the income, or in this case the citizenship, moves. This is why tax revenue increased when Reagan cut marginal rates; less game playing to hide the income, and more honest investment and reported wages exposed to a fair rate.Bleyseng wrote:"It was projected to generate $8.7 billion over 10 years, according to the congressional Joint Committee on Taxation."

Yep, maybe this will help to catch the tax dodgers living outside the US. When I lived in Suriname I filed taxes in both countries, big deal.

Geoff

77 Sage Green Westy- CS 2.0L-160,000 miles

70 Ghia vert, black, stock 1600SP,- 139,000 miles,

76 914 2.1L-Nepal Orange- 160,000+ miles

http://bleysengaway.blogspot.com/

77 Sage Green Westy- CS 2.0L-160,000 miles

70 Ghia vert, black, stock 1600SP,- 139,000 miles,

76 914 2.1L-Nepal Orange- 160,000+ miles

http://bleysengaway.blogspot.com/

- hippiewannabe

- Old School!

- Status: Offline

Re: Moving?

Yes. When Reagan cut tax rates, revenue went up. The Laffer Curve is an empirically proven fact.Bleyseng wrote:Huh? Then why did he run such huge deficits. I thought it was just like GW Bush that they cut the taxes and spent more expecting the economy to boom but it didn't happen. (Trickle Down Economics) Same BS the GOP is mouthing now.hippiewannabe wrote:Classic case of static analysis. In the real world, people and the economy are dynamic. When you go after a higher percentage of people's income, they don't just stand there and take it; the income, or in this case the citizenship, moves. This is why tax revenue increased when Reagan cut marginal rates; less game playing to hide the income, and more honest investment and reported wages exposed to a fair rate.Bleyseng wrote:"It was projected to generate $8.7 billion over 10 years, according to the congressional Joint Committee on Taxation."

Yep, maybe this will help to catch the tax dodgers living outside the US. When I lived in Suriname I filed taxes in both countries, big deal.

The deficits were caused by excess spending. He rebuilt the military while also letting entitlements grow. Hey, nobody's perfect.

The fact that revenue went down when Bush2 cut rates further says we are near the peak of the Laffer Curve. If you change rates either up or down from here, revenue will likely go down.

Truth is like poetry.

And most people fucking hate poetry.

And most people fucking hate poetry.